Affiliate disclosure: This post may contain affiliate links. Please see our Privacy Policy.

Preparing for hyperinflation can be difficult, but there are a few strategies that can help you survive hyperinflation without losing your shirt.

(This post is written by my husband Jack, who takes charge of our financial preparedness. He is not a financial advisor, but he is well-versed in history, especially in places that have experienced financial collapse. He takes to heart the old adage that those who don’t know history are doomed to repeat it.)

Inflation is never welcome, as we in the United States have learned with our recent bout of ever-increasing prices. After decades where the inflation rate seldom exceeded 2% year over year, seeing prices go up by 10% or more was a most unwelcome surprise for all of us. But those increases are nothing compared to hyperinflation, which is generally defined as inflation of 50% or more on a month-to-month basis; that means situations where the real buying power of the currency drops by half in just one month.

Worse, once hyperinflation starts, it is very difficult to stop. After all, if you had just seen the value of your hard-earned money drop by half in a month, what would be your natural reaction?

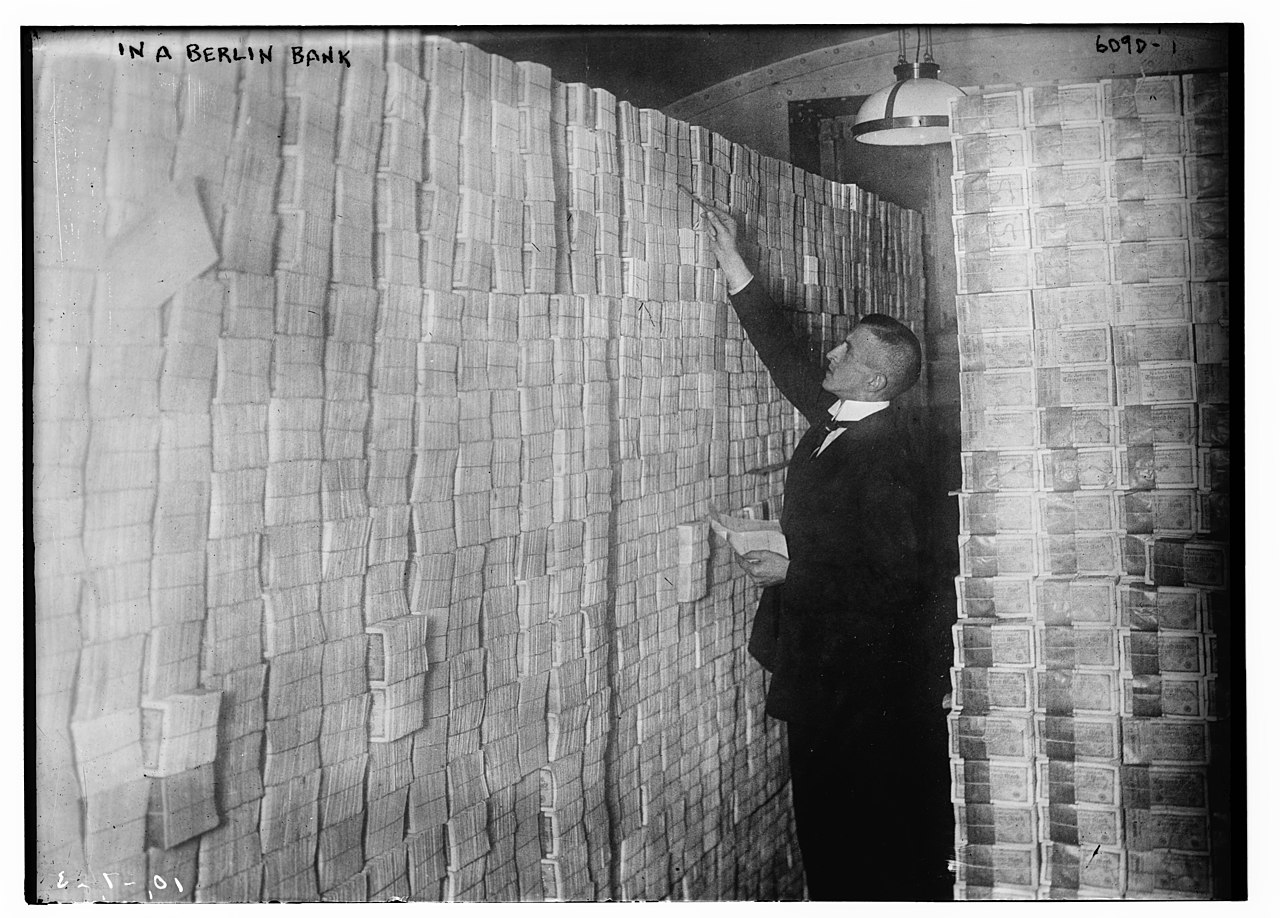

Probably, to spend every dollar that you can spare on just about anything that might retain value. And everyone else, having the same reaction, will cause the market to become flooded with yet more currency, increasing prices further. And within months, you are recreating the pictures from Zimbabwe and Weimar Germany of people pushing around wheelbarrows of formerly valuable currency just to buy a loaf of bread.

Hyperinflation has occurred in many countries in the last 100 years, including in Germany, Hungary, Argentina, Brazil, Turkey, and Venezuela. In most cases, it took years for the hyperinflation to stop and then many years more for their economies to recover.

How could this happen? And what – if anything – should you do to prepare for it?

What Causes Hyperinflation?

The exact circumstances leading up to hyperinflation are always a bit different, but in the end, there is always a single root cause.

A government encounters some crisis, like a war or economic crisis. In response, it prints large amounts of money to cover the costs.

The increase in the money supply, and doubts about the future stability of the currency, cause citizens to exchange their inflating currency with hard goods while they can. Simple supply and demand results in prices increasing even further, and in response, the government prints even more money, attempting to spend its way out of the situation.

Prices start increasing exponentially, and eventually, anyone who held the currency is wiped out.

Who Benefits, and Who is Hurt By Hyperinflation?

Having debt when the economy is experiencing high inflation can be either disastrous or fairly good news.

For variable-rate debts such as adjustable-rate mortgages (ARM) or credit cards, the rates will tend to increase over time to keep up with the inflating currency, making payments even more burdensome.

In contrast, if you have loans that are both low-rate and non-adjustable, high inflation is literally free money, as inflation eats away at the real value of the loan. For most people, the only such available loan is a mortgage. Anyone in the US who took out a 2.5% fixed 30-year mortgage in 2021, just before inflation hit highs not seen in 40 years, is doing very well for themselves.

So you should work to pay down any high-interest or variable-interest loans you have; hyperinflation or not, that’s just sound financial sense.

How To Store Wealth During Hyperinflation

Whether you have $10 or $10 million in the bank, it is yours. Losing 90% or more of the purchasing power of what you have worked to save is theft on a massive scale by an irresponsible government, and if you think this is a situation worth being concerned with, it’s good to have a plan for how to at least limit the damage.

Foreign Currency

One very common solution for people overseas has been to either open bank accounts denominated in a foreign currency or get ahold of physical banknotes from that country. By holding their wealth in a stable currency, they avoid the hyperinflationary effects.

For example, holding US dollars in the bank was very common in Argentina, which has experienced high or at points, hyperinflation in several spells since the 1980s.

However, foreign currency bank accounts can be risky in this situation, as Argentinians discovered when their US dollar holdings in the banks were forcibly converted into rapidly depreciating pesos. In 2002 the Argentine government effectively decreed that a dollar was worth 1.4 pesos, even though the peso was worth much less in reality, and converted all private dollar bank accounts into pesos at that fixed rate. Within a year, the peso had lost over half of its value relative to the already fraudulent conversion rate.

Physical banknotes are light, easily transported, and safe from confiscation by government ruling, but they are also easily stolen by thieves, so you’ll need good ways to secure or hide them.

For people in many countries, holding US dollars is the canonical store of wealth. It is estimated that over 80% of all $100 bills in existence are stored overseas, mostly by people in unstable countries who want to preserve their buying power.

For those of us in the United States, this is both good and bad news.

Everyone believes in the strength of the US dollar and the US economy (at least compared to their local currency), but it doesn’t leave those of us in the United States many good alternatives. If the US ever did experience hyperinflation, there would be no obvious safe currency for anyone to turn to.

Crypto Currencies

Lacking a reasonable state-backed currency to turn to, one option is cryptocurrencies like Bitcoin or Ethereum.

There are some interesting benefits to cryptocurrencies, especially compared to physical banknotes or precious metal coins – they are usually (effectively) infinitely subdividable, and you can send funds to anyone worldwide with a modest fee.

But there are also downsides and dangers – most cryptocurrencies are more volatile in price than many other assets. Depending on where you live, it may prove difficult to find anyone willing to exchange physical goods for a cryptocurrency transfer.

There are “stablecoin” cryptocurrencies, which attempt to provide a fixed price over time, but unfortunately, this price is usually denominated in dollars, which does not help much in a hyperinflationary scenario.

Cryptocurrency holdings are also fragile; if you lose the cryptographic key which is associated with your funds, they are gone forever – no do-overs. And storing your cryptocurrency on an exchange like Coinbase or FTX leaves it vulnerable to exchange failure, or seizure by a desperate government. Several cryptocurrency exchanges, including FTX and MtGox, have collapsed due to incompetence or outright fraud; unlike a traditional bank, when this happens, there is little recourse, and many people have lost large sums of money.

Probably the safest way to store cryptocurrency in the long term is to save the keys to a pair of secure hardware devices, and then store them in two different protected and hidden locations. Storing cryptocurrency properly, especially for the long term, is a complicated topic, and you should do careful research before storing large sums in these systems.

Metal

Precious metals, especially silver, and gold, are the classic safe haven when high inflation rears. But it is not so clear that either is particularly effective at preserving wealth in ordinary inflationary environments.

Between January 2010 and today, the United States has (according to the Bureau of Labor Statistics) experienced inflation of 38%. During that same period, the price of silver, denominated in dollars, is basically unchanged, and the price of gold is up perhaps 30%.

So holding metal certainly does not seem like a great way to get rich. That said, if you expect a hyperinflationary collapse, precious metals would preserve at least some of your wealth.

In addition to silver and gold, a stockpile of “lead” and “steel” is always a welcome trade good.

What to Buy Before Hyperinflation

If you’re seriously concerned about hyperinflation, storing wealth in terms of durable goods is often a better option than currency (even hard metal currency).

Land

Land is the classic hedge against monetary inflation.

As Mark Twain observed, they aren’t making any more of it. This goes double if your land can actually produce income. If you can sell vegetables you grew in your garden, eggs from your chickens, or firewood from your woodlot, then you have a little help in keeping your head above water in a hyperinflationary economy.

Tools / Industrial Equipment

Tools – anything from a 3D printer to a freeze dryer to a bulldozer, are relatively good stores of economic value. Like good land, tools can be used to produce income in the future. For example, if you have a freeze-dryer, you can make and sell freeze-dried food, or trade it for other goods you need.

Knowing how to preserve food, be it by canning, salting, or freeze drying also inadvertently gives you access to food. If someone grew a bumper crop of food, you could offer to preserve it for them for a fraction of the crop. That’s where having the tools, equipment and know-how ahead of time really pays off in a hyperinflation scenario.

As with anything, there are downsides. Tools useful for income generation are typically large and heavy, so you can only store so many of them, and if you want to sell one, moving it might prove tricky. But if you think you would be able to use some tool in your day-to-day life and/or for income-generating purposes later on, it’s worth consideration.

Lead and Steel

As mentioned above, a stockpile of “lead” and “steel” is actually a better trade good than gold in most circumstances. Beyond their value as a trade goods, those types of metals are also handy given the other consequences of hyperinflation…namely civil unrest and disorder.

Skills

Last but not least, invest in yourself now by learning useful skills.

Unlike a depreciating currency locked up in a failing bank, the skills you learn and maintain are yours forever. If you can bake bread, care for a child, forage for mushrooms, can food, build a simple website, fish, and fix a leaking sink, you will always have some way to make ends meet.

Other Considerations

Beyond simply storing and preserving wealth during hyperinflation, there are other considerations. If hyperinflation happens, it’ll also naturally impact other parts of society.

Economic and Trade Disruption

Hyperinflation disrupts the normal course of international trade because the exporting nations will have little interest in taking payment in a worthless currency. Especially for the United States, which is heavily reliant on imports for many basic products, life would be quite different; think of the supply chain disruptions we saw in 2020, and make them ten times worse.

Acquire and maintain a stock of non-perishable food, along with basic items for life, health, and happiness. These are useful in emergencies of all kinds.

Social Stability

Hyperinflation is not an individual experience; when it happens, the entire nation suffers. There will be discontent, and some people will grow desperate.

Have some means for self-defense, know your neighbors, and keep yourself healthy.

Is Hyperinflation Likely In The United States?

Thankfully, it really is not.

For a variety of reasons, the US dollar is considered a safe haven both by foreign governments and many people overseas, who are happy to hold dollars as part of their portfolio.

Don’t panic.

But also remember the prepper’s paradox: being on time is too late.

By the time “hyperinflation” appears in a local newspaper headline, prices will have already spiraled far out of control.

Be vigilant, have a plan, and be ready to execute if the circumstances call for it.

Preparedness Resources

Looking for more preparedness resources?

- Best (and Worst) Emergency Food Suppliers

- How to Prepare for WWIII

- Survival Gardening: Our Real Life Dry Run

- Best MRE Meals (Meals Ready to Eat)

- How to Store Gasoline (and Why You Should)

- Emergency Water Filtration Options

This is such a well-thought out article with many valuable ideas! May I share it in our local newspaper if I give credit and let them know where to find more information?

Thank you for the great information – I love Ashley’s ideas as well! I had planned to do an article this month on things to do with edible flowers that I’d also like to link back to Practical Self Reliance.com

Appreciatively,

Cynthia

Thank you. We’re so glad that you enjoyed the article. I’m assuming you’re planning to write your own article but just referencing the link to this post for more information?