Affiliate disclosure: This post may contain affiliate links. Please see our Privacy Policy.

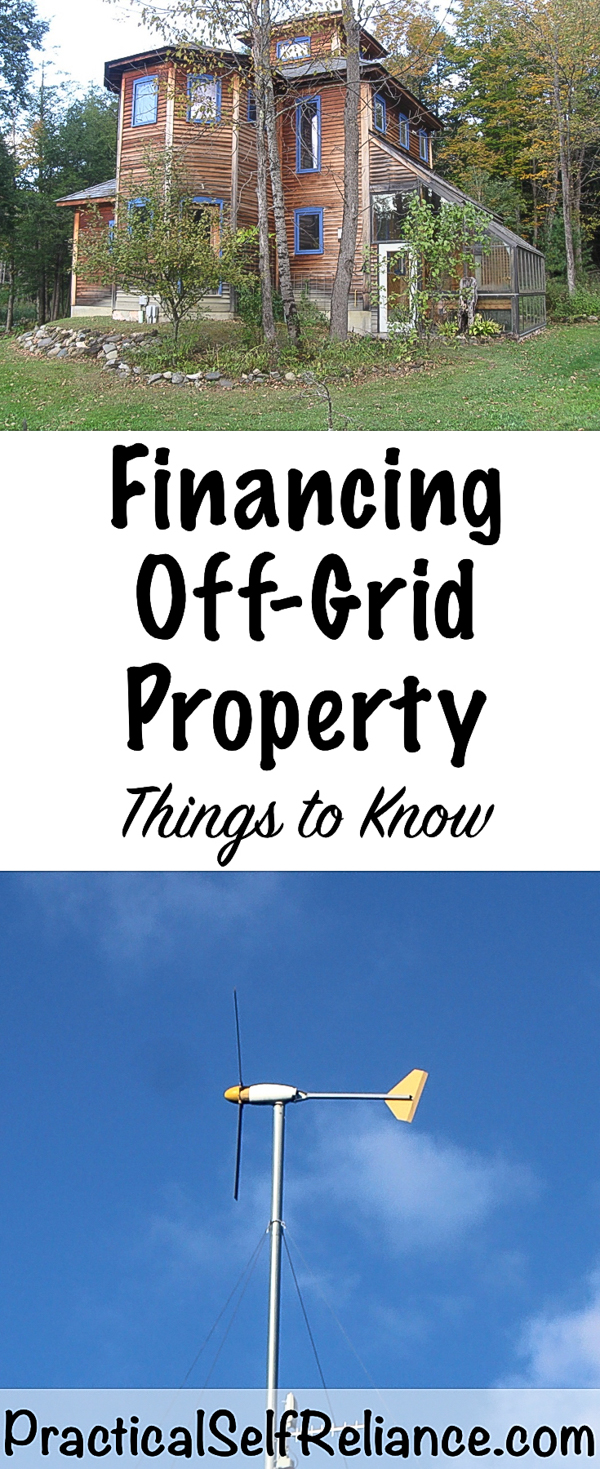

When my husband and I found our forever homestead, we had saved a sizable nest egg, but nowhere near enough to purchase it outright. We were in our 20’s and had no intention of waiting until we were middle-aged to start living the life we’d dreamed.

Taking on debt is never an appealing prospect, and we’re both opposed to it in principle, but we were willing to make an exception for a mortgage. We hadn’t planned on moving off the grid, but as we searched for property, we didn’t have much luck with traditional properties. The only affordable properties were off the grid.

If we could find a way to make a stable, full-time income off-grid then we could change our lives and circumstances now, not 20 years from now.

In all our dreaming and scheming, we didn’t know about the particular difficulties of financing off-grid property.

An off-grid home cannot qualify for a traditional mortgage, and the financing has to take place outside of the traditional fannie mae or freddy mac financing system. You have to find a bank that’s willing to take your case on as part of a special risk portfolio.

They’re worried that if you default, they’ll have trouble finding a buyer for something other than a cookie-cutter house in the suburbs.

As a result, things aren’t quite as straightforward and it can be tricky to find a bank willing to finance.

Off-Grid Mortgage Interest Rate Penalty

The biggest surprise trying to find mortgage financing for off-grid property was the interest rate. We were buying when rates were absurdly low, around 3.5%. By all accounts, that’s the ideal time to finance anything.

Financing off-grid property is not quite so straightforward. Since off-grid property doesn’t qualify for a traditional mortgage, it also doesn’t qualify for traditional interest rates. It seems that the standard practice is to charge a 1% penalty for a “non-conforming” mortgage.

We heard that from every bank that was willing to talk to us. If we wanted to finance off-grid property, we’d have to pay 1% above the going market rate.

Benefits of a Non-Traditional Mortgage

So while I was cranky about the 1% interest rate penalty for a non-traditional mortgage, my husband was happy to pay the premium. Why? Since we weren’t applying for a traditional mortgage, we weren’t going to be a commodity.

A “portfolio” mortgage is something that a bank chooses to take on at its own risk. They cant sell it on the open mortgage market.

Bank of America or some other global conglomerate would never buy our mortgage. My mortgage check would always be payable to the bank down the street.

After watching all the big bank horror stories in the mortgage crisis, we were happy to be out of the commodity mortgage market.

Find a Credit Union

Big banks didn’t want to talk to us. But honestly, I didn’t much want to talk to big banks as I mentioned above. Bank of America and Wells Fargo have had their share of scandals with consumers, and in the long run, it pays to keep your money local.

We found multiple different credit unions had options for off-grid home loans, and they were eager to take us on as a risk. When you live in the backwoods, the people manning the mortgage desk at the local credit union also live in the backwoods. They understand where you’re coming from, and don’t bat an eye when you say it’s off-grid.

Consider a 10 or 15 Year Loan

If you’re going to pay an extra 1% penalty, you might as well try to pay off that loan as fast as you possibly can. Shorter-term loans, with a 10 or 15-year duration, actually offer reduced interest rates too.

At least when we were financing, a 15-year loan charged on average 1% less than a 30-year loan. A 10-year mortgage was even less, but we couldn’t quite swing the higher payment.

With a shorter-term loan you end up paying a higher payment up front, but much less interest in the long run. Since the interest rate is also lower, it’s a great way to make up for that 1% off-grid interest rate penalty.

Try Owner Financing

Around these parts, there are plenty of owners willing to commit to owner financing. Perhaps it’s a desire to keep all middlemen out of the transaction, but that live free or die spirit lives on.

That wasn’t an option in our case, and honestly, I was glad. I’d rather cut ties altogether with the former owner and have any dealings on the property be my business. It’s irrational perhaps, but to me, owner financing seems too much like a rent-to-own situation with a landlord.

Nonetheless, there are countless for sale by owner signs on back streets with a note saying “owner financing available.” If for some reason traditional financing won’t work, perhaps the previous owner will work with you.

Get a Quote to Go on Grid

Some of the banks we talked to wanted us to show them a quote for the cost of going on the grid. It’s not that we were planning to go on the grid, but it was one of their requirements.

They wanted to be sure that the house and land appraised for at least the combined total of the purchase price plus the cost to connect to the grid. That’s an insurance policy for them if we default.

It’s also a good thing to have in your pocket. Though it’s never something to wish for, at some point the costs to repair some portion of the solar system may be higher than the cost to go on the grid.

It depends on your specific circumstances and how far you are from the nearest power pole. Having a total cost can be useful for planning, even if you plan to never use it.

Be Careful Selecting an Inspector

Picking a home inspector is a tricky prospect. You want the home to pass inspection so that you can get financing, but you also want to know what’s potentially wrong with the home. Our inspector advertised that he was an engineer in a former career and that he knew about solar.

He “inspected” the house and passed it with flying colors, which was great for financing, but not so great in the long run. The electrical system was horribly and dangerously not to code, with open wires everywhere. The entire battery bank died within a month of our move-in date, and batteries aren’t cheap.

If we would have seen all these things in the purchase process, we could have used it to get the previous owners to move on the price. Instead, we got relatively quick financing but had huge expenses in repairs after the fact.

Would we do it again?

At this point, we have no regrets. We’re 5 years into a 15-year mortgage, and we’ve put every extra penny we could scrounge into it. With luck, we’ll have it fully paid off in 6 or 7 years, before our oldest child’s 10th birthday.

For now, we’ve moved into “semi-retirement” as our fruit trees grow and establish, still working quite a few hours to make a full-time income off the grid. They’ll be at bearing age right around the time we retire to tending them full time.

Thanks, Ashley for all the info. We have lived Off-Grid for over 27 years and wondered how hard it would be to sell if needed. We live in AZ which is great for solar electric but horrible for the extreme heat! When we moved here from Phx the high temps were 85. Now they get to 106! No A/C!

Any other tips on selling and loans would be helpful.

Thanks, again,

Peggy

I appreciate the comprehensive breakdown of financing options tailored to this unique niche.

Thank you so much for taking the time to write this article. Incredibly helpful!

Thanks for the info. I too am running into the financing issue for an off-grid property. Never thought it would be an issue. Will look at local banks, my preference anyway …

You’re welcome. So glad you enjoyed the article.

Yes, I totally agree with what you said. I also think that picking a home inspector is a tricky prospect. I think that we must be very careful regarding it in order to avoid issues.

I have an offgrid property in Pioneertown CA for sale. It’s on Zillow at 48300 Burns Canyon Rd Pioneertown CA. 5ac 2 bd 1 bath and a 1200sqft steel workshop. New solar, roof, beautiful wrap around on 2 sides patio. $319,000.

Amazing 4Wheel drive trails. About 40 mi from world famous King of The Hammers off road race.

We are looking at properties in Oregon. Some are off grid and I had heard that it was difficult to get financing. Thank you for explaining the “whys.” It makes sense. If there was more demand for off grid properties, the banks would be happy to work with you, I am sure.

I also think that taking debt is definitely a no for me but also think that it is helpful too sometimes, we just have to be very careful and and responsible in using it. This article is very helpful for me. Thanks for sharing this article.

I am 58, 59 in August, I have never owned a home or had enough money to buy anything till now i am geting back pay from ssi and disability with monthly payments of almost 2ooo.oo and found a home in alaska i really want.

My siblings do not believe in this and try to discourage me.

I know I should qualify for a first time homeowner but do know what to do.

I HAVE AN OFF GRID HERE IN COLORADO FOR SALE

Where?!?!?! We’re stuck in Wyoming but can’t wait to get home to Colorado!!

Hello Ashley,my name is Michelle and we have a 44acre ranch in California for sale and was in escrow but the buyers just cancelled because of everything you just mentioned. The realtor and I are looking for lenders to have in our back pocket. Can you recommend any particular private lender or resource that might have a list of possible non confirming lenders. Any assistance would be greatly appreciated. Thank you. I really appreciated your post. 🙂

Hi Michelle,

So sorry that happened to you! I don’t know any lenders on a national scale that do Off-grid financing, both times we’ve done it it was with small local banks. The thing is, we didn’t even know those local banks offered that service. We used a mortgage broker (Rob at Title Mortgage) and they were very familiar with all the technicalities. They had no issues at all with setting up off-grid financing, didn’t even flinch at it. They’re in NH, but it’s worth a shot, they might know of national banks that offer it. They might also be able to refer you to a mortgage broker out where you are. Good luck!

How much did you have to put down in order to qualify for the off grid loan? We’re trying to buy an off grid house in VT and it’s been a very exhausting process loan wise.

Thank you so much for the helpful article!

There was no requirement actually, at least when we did it, but we had saved quite a bit and put down quite a bit if I remember right… If you’re in Vermont, try talking to VSECU or Woodsville Guarantee Savings Bank, they both do off-grid loans locally here. Good Luck!

Try North American Savings Bank. We were able to get a loan for our 40 acres and off grid home from. It was a conventional non-conforming loan. It wound up being 1% more than what the rates were at the time, but at least we were able to get financing.

WOW!!! MANY THANKS for this article, we are currently doing our due diligence on buying a property but Power is $200K to bring in so we figured we go solar for 1/2 the price BUT never did we imagine construction loans would be this difficult for an off grid home. I will add this to my due diligence list and get more i fo from banks…to the person who recommended North American Financial, many thanks!! I will give them a call.

We need a construction loan and then we would need to roll that into a conventional loan.

Thanks again for this insightful article!

GOD BLESS EVERYONE

Michelle,

Have you sold your 40 acre ranch yet? If not, I’d be delighted if you could send me the details.

Thank You

Sarah

Do you know if you can get VA loan for off grid?

When I call I get a bit of run around!

I don’t have the answer to that one, unfortunately. My best guess would be no, since off-grid property loans are usually only funded by private investment (ie. portfolio loans v. a standard Fannie Mae thing). Since VA loans are a government thing, I’d assume they’re quite restrictive. That said, I honestly have no idea and hopefully, you can just get them to give you straight answers. Sorry you’re getting the runaround, financing is no fun in any case, but a lack of straight answers is just frustrating!

I currently have a VA loan with American Financial Network. It’s off grid in Colorado

USDA loan is the best way to go. 0% down, just as VA

We have an odf ths grid house for sale in MT. It is nice to know there are options for buyers. The realtor we hired is telling everyone cash only.

Needless to say they haven’t even shown the house and the 3y acres.

Juli,

Did u ever sell your property. And where in MT?

Kfifield@whidbey.net

Fascinating! I wondered about the intricacies of getting a mortgage for a nontraditional property. Not at all surprised that you can’t go the typical route, but as you said, steering clear of Fannie and Freddie has its advantages.